The complex M&A terrain involves multiple steps before a deal’s fate is sealed, and commercial due diligence is one integral part of it. Bidders and vendors initiate this process to accurately explore the target business’s commercial potential. Commercial due diligence (CDD) often precedes the final stages of business transactions so interested parties know what they are getting into. It unravels all the facts and data around competitors, the company’s position, ability for growth, market trends, and customer preferences.

In a nutshell, CDD plays a critical role in decision-making, decreasing transaction risks by providing deeper insights beyond a business’s financial health through the commercial context. Stakeholders can rely on CDD to turn their deal into a long-term success by accounting for threats, weaknesses, opportunities, and strengths.

Since this type of due diligence can be a game changer, all the parties should pursue this carefully. Here is a commercial due diligence checklist to help you cover every aspect.

- CDD key components

It starts with probing a target company’s business plan and corporate structure. These give a detailed view of the business model, strategies, objectives, financial goals, affiliations, JVs, and corporate hierarchy. A comprehensive CDD will help you delve into four critical aspects: market, finances, operations, and legalities. Financial analysis reveals the target business’s cash flow, revenue patterns, profits, and risks based on financial statements, capital, and predictions. This step allows bidders and vendors to understand the company’s current and future status clearly.

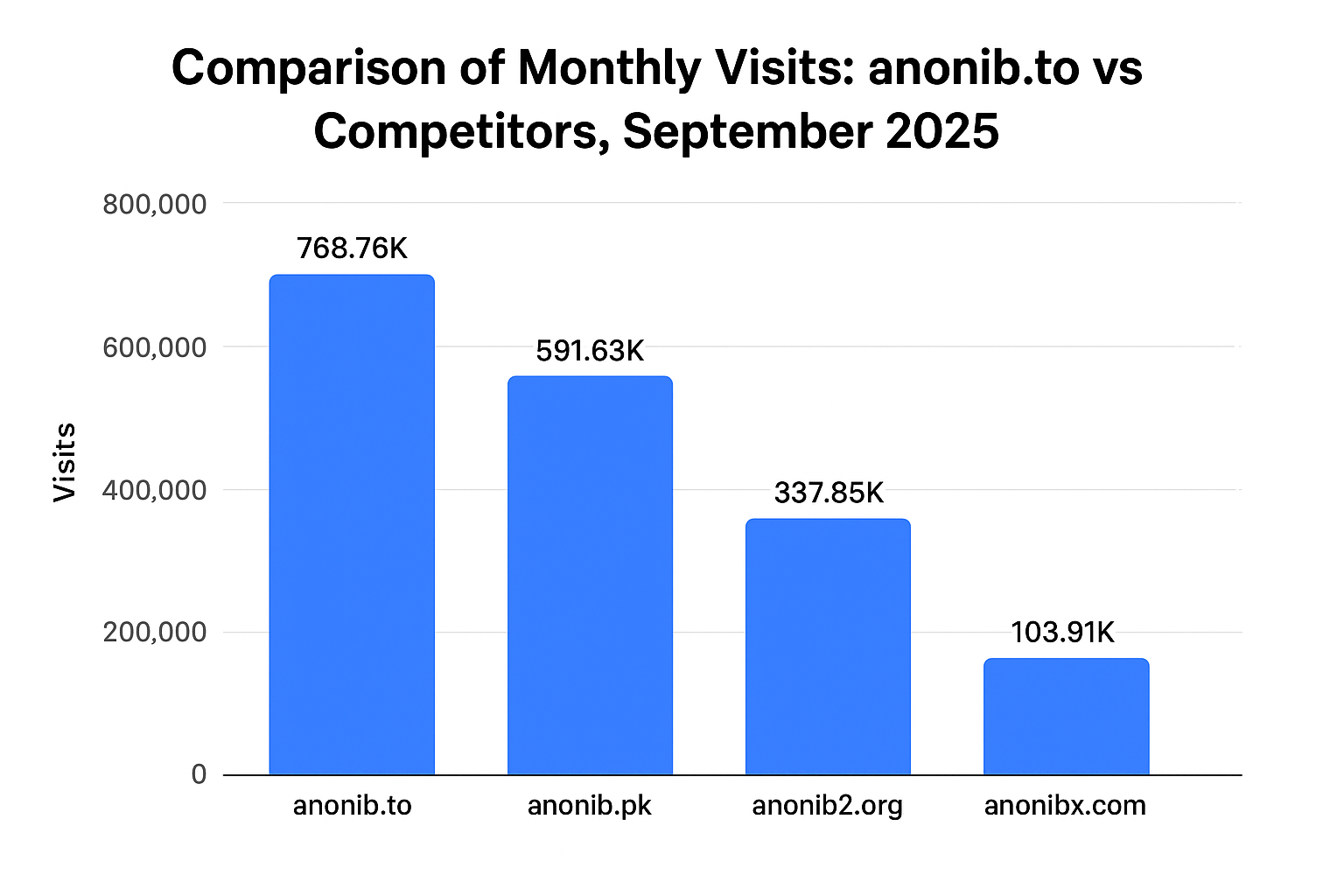

Market assessment is necessary to understand the market size of the business, competitors, market trends, and growth potential. It enables parties to understand the company’s position and its customer base. Suppose a specific company operates in a highly competitive landscape. In that case, you can predict the challenges it will face to maintain its market share.

Regulatory environments can impact a business’s market share and operations drastically. Digging into the company’s legal and regulatory compliance matters is essential to learn about IP rights, contracts, and litigation. Finally, an insight into the company’s operations can reveal its supply chain, manufacturing capabilities, and tech infrastructure. You also understand its management and employee skills better.

- CDD process

Conducting commercial due diligence is crucial to spot opportunities and risks in the target company. It is a preliminary investigation of the business model, revenue streams, and cost factors. It acquaints you with the industry it belongs to, its competitiveness, and market trends. The next step leads to analyzing financial reports and performance.

You check everything from income statements, balance sheets, and cash flow reports. These signal the business’s liquidity, economic well-being, and profitability. Legal due diligence helps you see a company’s performance in legal and regulatory matters through agreements, contracts, licenses, etc. You also know whether the company complies with employment, labor, and other laws.

Assessing market conditions and operations is equally vital. Knowing the target company’s market helps you decipher the scope of growth, trends, competition, and industry size. It leads you to the position of the business in its respective field and competitive edge. Operational evaluation indicates if all the concerned business’s patents, IP rights, copyrights, and trademarks are valid and safe. It studies the effects of the regulatory changes on its existence.

To conclude, comprehensive due diligence is a way to make an informed decision about a significant merger and acquisition. Some online platforms can assist you in these aspects.

For More Information Visit Our Homepage: