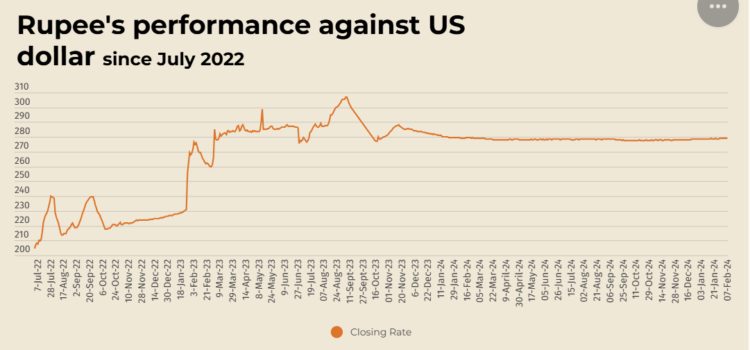

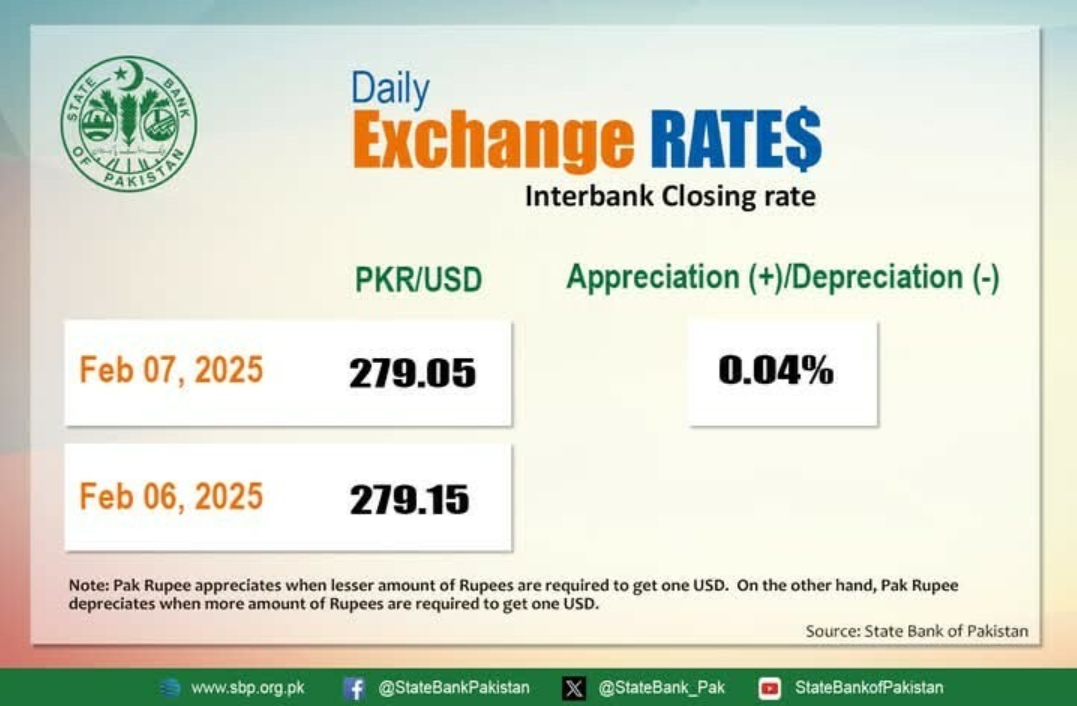

The Pakistani rupee (PKR) showed slight improvement against the US dollar (USD) in the interbank market on Friday, appreciating by 0.04%. According to the State Bank of Pakistan (SBP), the local currency closed at 279.05, gaining Re0.10 compared to the previous day’s closing rate of 279.15.

Interbank Market Update

The exchange rate stability reflects measured forex market activity as economic indicators continue to evolve. Traders and analysts closely monitored these fluctuations amid shifting global economic trends.

International Forex Market Trends

Globally, the Japanese yen surged to a nine-week high as investors bet on further interest rate hikes in Japan. Meanwhile, the US dollar and other major currencies showed limited movement ahead of the release of US monthly payroll data.

Throughout the week, markets experienced volatility due to conflicting reports on US tariff threats. Investors remained cautious while awaiting employment figures and monitoring geopolitical developments, particularly US policy shifts.

The US labor market remains robust, with economists polled by Reuters expecting the January unemployment rate to hold steady at 4.1%, while the economy is projected to have added 170,000 jobs. However, analysts warn that interpreting January employment data may pose challenges due to seasonal adjustments.

The US dollar index, which tracks the currency against major counterparts like the yen and sterling, remained stable at 107.69 after spiking to 109.88 earlier in the week due to tariff-related concerns.

Oil Prices and Their Impact on Currency Markets

Oil prices, a crucial determinant of currency strength, recorded minor gains in Asian trading on Friday. However, crude prices remained on track for a third consecutive weekly decline due to renewed US trade tensions with China and tariff threats on other nations.

- Brent crude futures: $74.81 per barrel (+52 cents) but down 2.5% for the week.

- US West Texas Intermediate (WTI) crude: $71.05 per barrel (+44 cents), reflecting a 2% weekly drop.

Interbank Exchange Rates (Friday)

- BID: Rs 279.05

- OFFER: Rs 279.25

Open Market Exchange Rates

In the open market, the PKR depreciated by 3 paise against the USD for buying, while selling remained stable.

Against Major Currencies

- US Dollar (USD):

- Buying: Rs 278.69

- Selling: Rs 280.90

- Euro (EUR):

- Buying: Rs 289.03 (-11 paise)

- Selling: Rs 292.09 (-17 paise)

- UAE Dirham (AED):

- Buying: Rs 75.96 (+2 paise)

- Selling: Rs 76.50 (unchanged)

- Saudi Riyal (SAR):

- Buying: Rs 74.21 (unchanged)

- Selling: Rs 74.75 (unchanged)

Market Outlook

The Pakistani rupee continues to display resilience amid global economic shifts. Investors and businesses should closely watch upcoming economic data releases, oil price fluctuations, and US trade policy updates to gauge future exchange rate movements.

For More Information Visit Our Homepage: