The intricate dance between Enterprise Risk Management (ERM) and Internal Control Frameworks (ICFs) is a cornerstone for organizational resilience and longevity in modern business. The symbiotic relationship between these two domains is crucial in navigating the complexities of today’s dynamic business landscape. Understanding COSO framework and compliance in detail lets the strategies employed by ERM enhance Internal Control Frameworks, emphasizing the importance of mastering the balance between risk and control.

Understanding the Dynamics

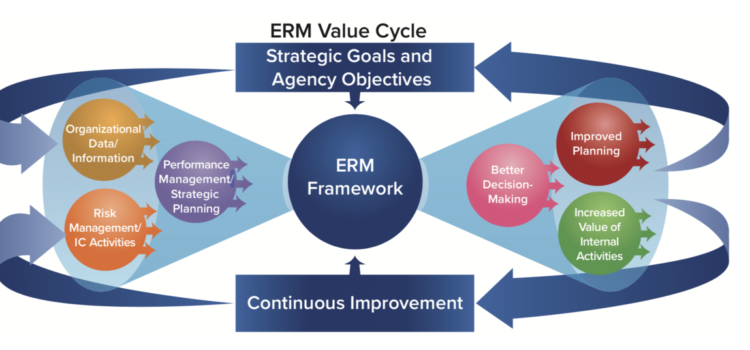

Effective risk management’s core lies in identifying, assessing, and mitigating risks that may impede organizational objectives. ERM frameworks provide a structured approach to achieving this, encompassing various processes and methodologies tailored to each organization’s unique needs. Concurrently, Internal Control Frameworks are designed to ensure the reliability of financial reporting, compliance with regulations, and safeguarding of assets.

Strategic alignment between ERM and Internal Control Frameworks fosters synergy, optimizing risk mitigation efforts and control activities. This alignment enhances risk-informed decision-making, empowering employees to navigate uncertainties confidently. Leveraging advanced analytics and technology further strengthens risk management practices, enabling real-time risk monitoring and adaptive control strategies.

Continuous monitoring and adaptation are essential in maintaining the effectiveness of internal controls amidst evolving risk landscapes. Risk-based auditing approaches complement traditional compliance-focused audits, providing deeper insights into key risk areas. Executive oversight and governance structures ensure accountability and transparency, establishing a robust risk management culture.

Mastering the balance between ERM and Internal Control Frameworks is critical for organizational resilience and long-term success in today’s dynamic business environment.

Strategic Alignment

To master the balance between ERM and Internal Control Frameworks, organizations must foster strategic alignment between these two domains. This entails integrating risk management principles into the fabric of internal controls, thereby enhancing their effectiveness and relevance. Organizations can proactively address potential threats by aligning risk mitigation efforts with control activities while optimizing resource allocation. Furthermore, establishing clear communication channels between risk management and control functions facilitates the timely identification and response to emerging risks.

By fostering collaboration and knowledge sharing, organizations can leverage the collective expertise of cross-functional teams to strengthen their risk management practices. Additionally, providing comprehensive training and development opportunities ensures employees have the necessary skills and knowledge to execute risk management and control initiatives effectively. Through these concerted efforts, organizations can cultivate a robust risk management framework that safeguards against potential threats and drives sustainable growth and innovation.

Risk-Informed Decision Making

One key strategy ERM employs in bolstering Internal Control Frameworks is promoting risk-informed decision-making across all levels of the organization. By embedding risk awareness into day-to-day operations, employees can make decisions that align with organizational objectives while mitigating potential risks.

This proactive approach enhances the efficacy of internal controls and fosters a culture of risk awareness and accountability. Furthermore, fostering open communication channels facilitates sharing risk-related information and insights, enabling employees to collaborate effectively in identifying and addressing potential risks.

Regular training and development initiatives enhance employees’ understanding of risk management principles and their application in various business scenarios. Risk-aware behavior also incentivises employees to proactively identify and report potential risks, strengthening the organization’s risk detection capabilities. Ultimately, organizations can create a resilient foundation for sustainable growth and success by instilling a risk awareness and accountability culture.

Understanding COSO Framework and Compliance

The COSO framework provides organizations with a structured approach to internal control, risk management, and compliance. It was developed by the committee, comprising five prominent accounting and auditing associations. This framework aims to enhance organizational performance by establishing principles and guidelines for effective governance, risk management, and control activities.

Within the COSO framework, compliance is an integral component that ensures organizations adhere to legal and regulatory requirements. Understanding the COSO framework in detail involves grasping its key elements and how they relate to compliance practices. These components include the control environment, control activities, information and communication, and monitoring activities.

Each component plays a crucial role in strengthening an organization’s compliance management. For instance, a robust control environment fosters a culture of integrity and ethical behavior, while practical risk assessment helps identify and prioritize compliance risks. Control activities implement policies and procedures to mitigate risks, while information and communication ensure relevant stakeholders are informed about compliance requirements. Lastly, monitoring activities evaluate the effectiveness of compliance controls and identify areas for improvement.

A comprehensive understanding of the COSO framework and its relationship with compliance is essential for organizations to establish and maintain effective compliance management systems.

Integration of Technology

In today’s digital age, leveraging technology is paramount in optimizing the synergy between ERM and Internal Control Frameworks. Advanced analytics, artificial intelligence, and automation tools can streamline risk assessment processes, enhance control monitoring capabilities, and facilitate real-time risk reporting.

By harnessing the power of technology, organizations can strengthen their risk management practices while improving operational efficiency. Moreover, integrating technology enables the implementation of predictive analytics models, allowing organizations to anticipate potential risks and take preemptive measures. Additionally, automation tools can expedite routine tasks like data collection and analysis, freeing up valuable resources for strategic risk management initiatives.

Technological solutions offer scalability and adaptability, enabling organizations to tailor risk management processes to their needs and evolving risk landscapes. Overall, embracing technology enhances the effectiveness of ERM and Internal Control Frameworks and positions organizations to thrive in an increasingly digital world.

Continuous Monitoring and Adaptation

The dynamic nature of risk necessitates continuous monitoring and adaptation of internal controls. ERM frameworks advocate for a proactive approach to risk management, emphasizing the importance of regular risk assessments and control evaluations. By monitoring key risk indicators and emerging trends, organizations can identify potential gaps in internal controls and take corrective action promptly.

Executive Oversight and Governance

Effective governance structures are essential in ensuring the alignment between ERM and Internal Control Frameworks. Executive oversight provides guidance and direction to integrate risk management practices into strategic decision-making. By fostering a culture of accountability and transparency, senior management sets the tone for risk-aware behavior across the organization.

Conclusion

In conclusion, understanding COSO framework and compliance in detail and mastering the balance between ERM and Internal Control Frameworks is imperative for organizations seeking to thrive in today’s volatile business environment. Strategically aligning risk management principles with internal controls can enhance organizations’ resilience, agility, and long-term viability. Organizations can confidently navigate uncertainties through proactive risk assessment, technology integration, and continuous monitoring, achieving sustainable growth and success.

For More Information visit our Homepage: