What is stochastic momentum index (SMI)

The Stochastic Momentum Index (SMI), is a Technical Indicator which measures the momentum in an asset’s prices. The SMI is an improved version of George Lane’s stochastic indicator, which was developed in the 1950s. The stochastic indicator measures the strength of a trend in an asset. It is based on the assumption that price trends are more likely to persist than reverse.

Understanding the Stochastic Oscillator

To recognize the SMI, it’s vital first to understand the stochastic oscillator. The stochastic oscillator is calculated through evaluating an asset’s final charge to its rate variety over a positive length. The charge range is the distinction among the best and lowest fees over the identical period.

The stochastic oscillator generates the %K line and the %D line. The %K line represents the current closing rate as a percentage of the charge range over a distinct length, commonly 14 days. The %D line is a shifting common of the %K line, generally calculated as a three-day simple shifting average.

Example scanners based on the Stochastic Momentum Index (SMI)

The Stochastic Momentum Index may be utilized in Scanning the market. To see how exactly it can be used in this way, we offer the subsequent samples. Both scanners seek the market for stocks the usage of this indicator.

How the Stochastic Momentum Index (SMI) is Calculated

The SMI is calculated further to the stochastic oscillator but uses a broader range of values and is greater touchy to final costs. The SMI is calculated through taking the difference between the contemporary remaining fee and the median high/low fee range over a designated length. This distinction is then divided by using the absolute value of the excessive/low range and expanded with the aid of a hundred.

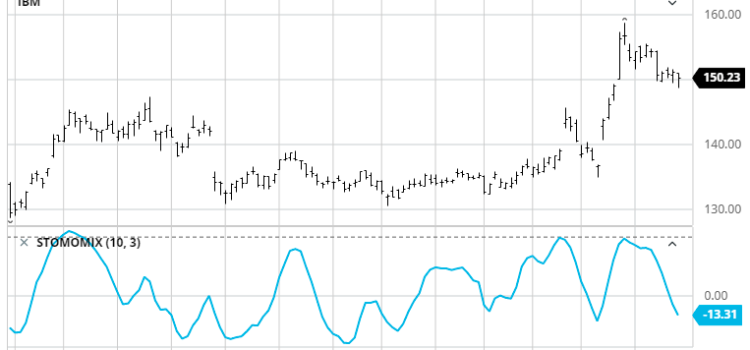

The SMI generates traces: the SMI line and the signal line. The SMI line represents the momentum of the asset’s fee, even as the sign line is a shifting average of the SMI line, normally calculated over three days.

Interpreting the SMI

The SMI is interpreted similarly to the stochastic indicator. The SMI line crossing above the signal line is considered a bullish sign, as it indicates that the asset price momentum is increasing. When the SMI crosses below the line of signal, it’s regarded as a negative signal. It indicates that the asset price momentum is decreasing.

To interpret the SMI, traders can also use Overbought or Oversold. The SMI line above +40 is overbought and indicates that the price of the asset may be due for correction. If the SMI line falls below -40 it is oversold and the asset price is likely to rise.

SMI – Interpretation

The SMI is interpreted similarly to the stochastic indicator. The SMI line crossing above the signal line is considered bullish and indicates that the asset price momentum is increasing. When the SMI crosses below the line of signal, it’s a bearish sign, as the asset’s momentum is declining.

To interpret the SMI, traders can also use Overbought or Oversold. The SMI line above +40 is overbought and indicates that the price of the asset may be due for correction. If the SMI line falls below -40 it is oversold and the asset price is likely to rise.

SMI vs. Stochastic oscillator

The SMI and the stochastic oscillator may be similar in some ways, but the two indicator are different in important ways. The SMI can be considered a refinement to the stochastic indicator, since it has a wider range of values. It is also more sensitive to closing price. The SMI has less false swings, and may be a more reliable tool than the stochastic indicator.

The way in which they are interpreted is another critical difference. The stochastic oscillator creates two lines while the SMI uses two lines to analyze signals. The SMI is a comprehensive indicator, providing more information on an asset’s momentum.

SMI vs. SMI Oscillator

Technical Indicators are used by traders to identify market conditions that are overbought or oversold. The SMI Ergodic Oscillator was developed from the Stochastic Oscillator. The SMI Ergodic Oscillator uses a wider range of values and is more sensitive to closing price changes. It’s less likely to give false signals because it has a larger range. The SMI Ergodic Oscillator also generates two lines, incorporating overbought or oversold levels, to provide a comprehensive analysis of the asset’s momentum. However, the Stochastic Momentum Index only generates one line. Both indicators are often used together by traders to get a better understanding of the market and make more informed decisions.

How to use the SMI for trading

SMI is a useful tool for traders looking to identify trend, and determine when to enter or leave a trade. A common way to use the SMI is by looking for bullish or negative divergences in the SMI line compared to the asset price. When the SMI line has higher lows and the asset price has lower lows, this is a bullish Divergence. This can indicate that the price of an asset will trend upwards. A bearish divergence is when the SMI line has lower highs and the price of an asset makes higher highs. This can indicate that the price of an asset is about to reverse, and begin a downward trend.

Traders may also identify entry and exit points by using the levels of overbought or oversold. If the SMI crosses above +40, this may be a sign to sell or take profit. When the SMI crosses below the -40 levels, it could be a sign to buy, or even enter a Long Position.

Limitations and risks of using the SMI

The SMI is a useful tool for traders but it’s important to understand its limitations and potential risks. The SMI, like all technical indicators is based on historical data and does NOT guarantee future performance. Traders must always use multiple analysis methods and indicators to confirm their decision.

The SMI can produce false signals in markets that are choppy or sideways, and this is especially true when the market is sideways. The SMI should be used with caution and traders must always be aware of the market conditions.

Example of a strategy based upon the Stochastic momentum index (SMI).

Test Strategies using the Stochastic Momentum index. We provide a sample to show how it can be used. The strategy tests the buying and selling rules based on this indicator.

Conclusion :

The Stochastic Momentum Index (SMI), a refinement to the stochastic indicator, can give traders valuable information on an asset’s momentum. The SMI has a wider range of values, and is more sensitive to closing prices. This makes it less susceptible to false swings. It could also be more reliable than the stochastic indicator. The SMI can be used by traders to identify trends, find divergences and potential entry and exit areas. Like all technical indicators the SMI also has limitations and risks. Traders should use multiple indicators to confirm their decision.

For More Information visit Our Homepage