Buyer optional organizations have turned into a convincing power in the continually changing Indian financial exchange, furnishing financial backers with a tempting blend of possibilities and potential returns. These stocks cover a great many businesses that fulfill purchasers’ needs and requirements for superfluous things, like extravagance items, diversion, design, and relaxation. With the country’s economy blasting and buyer buying power rising, shopper optional values have become progressively engaging. So going for best demat account opening app would be the best choice. Traders who are trend-spotters who like taking measured chances are interested in this emerging market, as they hope to profit from the shifting tastes and way of life of India’s growing middle class.

The Rise of the Aspirational Indian Consumer

The increment of the working class and the nation’s developing economy may be the fundamental drivers of the optimistic shopper pattern in India. Interest for extravagance items and top notch encounters is ascending as additional individuals hope to enjoy life’s better joys because of rising dispensable wages. The present Indian client requests something other than fundamental necessities; they need in vogue clothing, very good quality beauty care products, lavish excursions, and remarkable eating encounters.

Due to this renewed demand for indulgence, consumer discretionary industries have experienced rapid development, offering investors numerous options to profit from this expanding industry. Businesses that offer luxury shopping, first-rate hospitality, or unique experiences to the aspirational Indian customer are well-positioned to prosper in this quickly changing environment and entice astute investors with the promise of large profits.

The Digital Revolution: E-commerce and Beyond

As a result of the digital revolution, consumer discretionary stocks are in transition, it is also changing consumer behaviour and relationships between businesses and their clients. The explosive growth of e-commerce platforms is leading this revolution – where the buying experience has been radically altered. These legions of online merchants that exist beyond national boundaries have brought a whole variety of goods and services within easy reach to the mass public, from travel and entertainment right down to beauty as well as fashion.

Besides e-commerce, consumer discretionary companies also have interests in the digital arena. The technology tools that are currently gaining them increasing market shares include virtual shopping apps which offer an immersive experience, digital service which is tailored to one’s personal requirements and data-driven insights. Businesses that engage in digital transformation can effectively excite today’s consumers as well as build a comparative advantage, ranging from AI-powered recommendations to “try before buy” experiences using augmented reality.

Investors that possess a sharp sense of innovation along with a comprehensive comprehension of technology developments are in a favourable position to profit from the expansion of these digital disruptors. Through the identification of companies that are leading the way in digital adoption and adeptly incorporating state-of-the-art technologies into their operations and customer experiences, investors can access profitable prospects within the constantly changing consumer discretionary market.

The Experiential Economy: Fuelling the Pursuit of Memorable Moments

Because of the cutting edge customer’s ravenous hunger for stand-out and extraordinary occasions, the experiential economy has arisen as a critical driver behind the ascent of purchaser optional organizations. Indians are searching for more as well as additional opportunities to fashion deep rooted recollections through vivid as well as groundbreaking encounters in when material effects are at this point not the main mark of satisfaction.

Because of this propensity, an extensive variety of purchaser optional organizations have arisen that help individuals’ requirement for groundbreaking encounters. Financial backers can look over many open doors in this flourishing industry, from thrilling experience travel organizations alongside an enrapturing amusement park to top notch foundations furnishing complex culinary encounters alongside vivid retail spaces that obscure the limits between diversion as well as shopping.

Organizations that are capable at making groundbreaking encounters, whether through best in class innovation, top notch client service, or unparalleled scrupulousness, are in areas of strength for a to prevail upon the hearts and wallets of experience looking for clients. Recognizing as well as gaining by these experiential pioneers can yield huge returns for financial backers in a market where shopper optional firms are driven by the requirement for critical encounters.

The Fitness Phenomenon: Embracing Health and Wellness

In the midst of a developing public consciousness of medical problems, the wellness and health areas have encountered unrivaled extension. Indians are turning out to be increasingly more worried about their physical and psychological wellness, which is driving up interest for wellness focuses, rec centers, alongside healthy eating choices, as well as health escapes.

Organizations in this purchaser optional area have happily seized the opportunity to fulfill the changing needs of clients who are wellbeing cognizant. Financial backers can gain by this quickly growing industry by picking organizations that are driving the manner in which in this game-evolving pattern, which goes from imaginative wellness ideas to maintainable and natural product offerings.

The Influence of Social Media and Celebrity Endorsements

Virtual entertainment and superstar supports have become critical elements in the computerized time, impacting client decisions and moving the presentation of shopper optional stocks. Influencers along with celebrity ambassadors have a great deal of power on consumer behaviour; their partnerships as well as endorsements frequently act as spurrents for both product demand and brand loyalty.

As these tactics have the potential to increase brand recognition, boost sales, and eventually affect stock performance, astute investors are closely monitoring businesses that successfully harness the power of social media in addition to celebrity endorsements. Finding businesses that thrive in this area might lead to profitable investment opportunities in the consumer discretionary industry.

The Road Ahead: Embracing the Opportunities

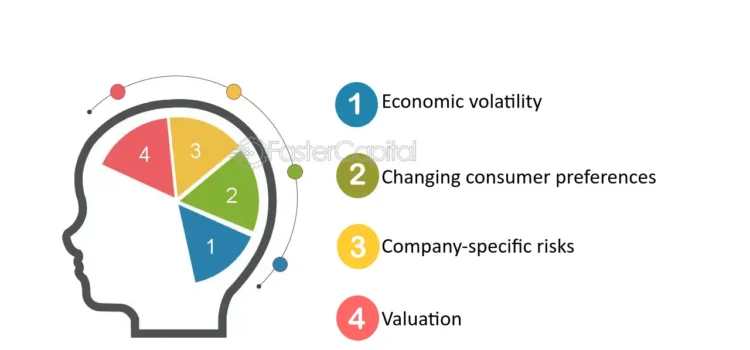

As the Indian economy advances further and consumer spending power hits record high on average, there will be many good opportunities for growth in the consumer discretionary sector. But in this fast-moving industry, how customers’ tastes are changing is one key question to gain a lot of flexibility which can adjust and turn with trends. It is additionally Important to take a strategic approach: Look for businesses that are perfectly placed for new opportunities.

To reach into the blue sky, an investment plan for the consumer discretionary stocks entrepreneur must include keeping abreast of stock market trends, thorough research, and a diverse portfolio. With these efforts, investors are in a position to reap rich rewards from this rapidly transforming industry and make use of every new chance that comes along.

Conclusion

The Indian stock market’s consumer discretionary sector is a dynamic and constantly changing landscape that presents a wide range of options for investors of demat trading app looking to profit from the country’s rising wealth as well as changing consumer tastes. This industry is a monument to the dynamic character of the Indian economy along with the limitless potential that exists within its borders, from the emergence of the ambitious Indian consumer to the digital revolution as well as the pursuit of unforgettable experiences.