INTRODUCTION:

What is “Biden Student Loan Forgiveness”. That means you won’t have to pay back some or all of your loan(s). The terms “forgiveness,” “cancellation,” and “discharge” mean essentially the same thing. Public Service Loan Forgiveness is the most common way people apply to have their student loan forgiveness Biden.

US President Joe Biden walks to board Marine One on the South Lawn as he departs the White House in Washington, DC, on August 15, 2023. A federal court dismissed a legal challenge to one of joe Biden student loan forgiveness initiatives on Monday. (Photo by Jim WATSON / AFP) (Photo by JIM WATSON/AFP via Getty Images)

For many Americans, the weight of student debt has long been a major concern since it prevents them from achieving financial stability and their aspirations. President Joe Biden has offered a number of student loan forgiveness Biden packages in response to this issue, all of which aim to lessen the burden of student debt. We’ll delve into the details of Biden’s student loan forgiveness initiatives in this book, offering light on the requirements for eligibility, the application procedures, and the capacity benefits they provide.

BILLIONS OF DOLLARS IN DEBT FORGIVENESS ARE GOING TO STUDENT LOAN BORROWERS THIS WEEK

According to “CBS NEWS” This week, more than 800,000 student loan borrowers with billions of dollars in debt will start to have their loans discharged.

The Biden administration announced last month that it will cancel student debts for 804,000 borrowers with a combined debt of $39 billion in federal student loans. This one-time account adjustment follows that announcement. The White House stated in a statement on Monday that these borrowers have been in income-driven repayment (IDR) programs for more than 20 years and “never got the credit they earned “under IDR plans.

” President Joe Biden stated in the statement that hundreds of thousands of students weren’t appropriately receiving credit for student loan payments that should have resulted in their loan forgiveness Biden under income-driven repayment arrangements. Their college loans will begin to be forgiven “this week.”

If you want to know more about this news click here

The ambitious plans for student loan forgiveness unveiled by President Biden

The goals of several young Americans seeking higher education have long been eclipsed by the weight of student debt. President Joe Biden made a bold move to address this pressing issue by announcing a comprehensive student loan forgiveness program designed to ease the financial burden on millions of borrowers. This article delves deeper into Biden’s broad plan, illuminating its possible implications and the options available to people struggling with the cost of higher education.

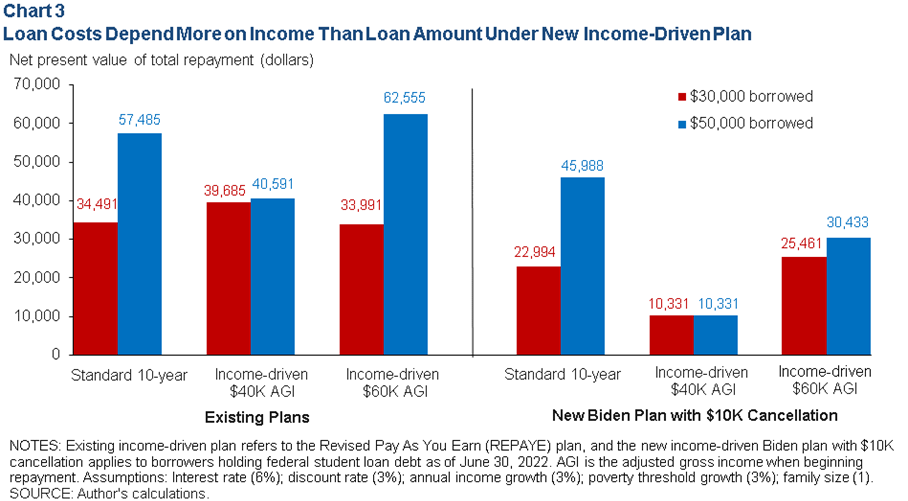

By giving tailored relief to particular borrower categories, President Biden’s approach establishes a precedent for tackling the student debt crisis. The idea offers assistance to federal student loan holders who are employed in the public, nonprofit, or educational sectors and offers increased forgiveness after a predetermined amount of time. The system also manages alternatives for income-driven repayment, letting borrowers establish monthly installments depending on income. The Biden administration hopes to give veterans serving their communities a more feasible road to financial stability by concentrating on these factors.

The administration of President Biden has announced a number of initiatives to help students who are struggling with student loan debt. These ideas aim to reduce the financial burden on debtors and make education even more affordable.

STUDENT LOAN FORGIVENESS PLAN: PERSPECTIVES ON BIDEN’S PLAN

As with any comprehensive policy idea, Biden’s offer to cancel student loans has drawn a lot of criticism and discussion. Supporters of the initiative applaud its goal of providing borrowers with much-needed relief so they can follow their lifestyle ambitions free from the paralysing shadow of debt. This perspective highlights the potential economic spillover that lower student loan debt may have by enabling people to make home investments, start businesses, and give back to their local communities.

On the flip side, the plan’s detractors express concerns about the ability financial impact and the equity to taxpayers. Some question if the idea adequately addresses the root causes of the student debt crisis and claim that blanket forgiveness may seek to burden taxpayers who did not benefit from higher education. The discussion also covers the effects on institutions of higher learning, as colleges may lack incentives to control training prices if significant Biden loan forgiveness becomes a reality.

The issue of whether student loan forgiveness should be extended to borrowers with great earning potential is one of the main points of dispute. Critics claim that granting loan forgiveness biden to those with high earning potential should unintentionally redistribute wealth upward, while supporters point out that these people have nonetheless made a contribution to the repayment of their loans and shouldn’t be denied comfort.

ELIGIBILITY CRITERIA:

- Loans: Federal student loans, along with direct loans and the Federal Family Education Loan (FFEL), frequently include forgiveness programs.

- Payment facts: Some plans demand that borrowers have a strong payment history in order to make certain on-time monthly payments.

- Employment requirements: Some amnesty requests concern certain industries, such as public employees or nonprofit organizations.

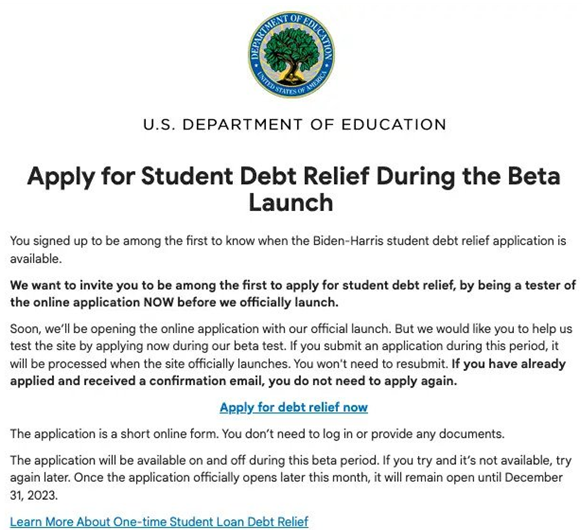

APPLICATION PROCESS:

- Gather Documentation: Gather all necessary documentation, as well as data on mortgages and proof of work in the required fields.

- Choose the Right Program: Choosing the right forgiveness program should entirely depend on your eligibility and available possibilities.

- Complete the Application: Complete the necessary paperwork precisely and include all necessary information.

- Submit and Await Approval: Send in your application, then wait for the mortgage servicer to get back to you.

- Stay Informed: Check frequently for developments and stay in touch with your mortgage servicer to make sure your application is handled quickly.

POTENTIAL BENEFITS OF BIDEN STUDENT LOAN FORGIVENESS PROGRAMS:

- Reduced Financial Stress: Loan forgiveness can significantly alleviate borrowers’ financial burdens, freeing up money for other important expenses and investments.

- Loan Repayment Acceleration: Some programs encourage professionals to contribute to areas of national importance by offering accelerated mortgage forgiveness to people working in vital fields.

- Improved Credit Scores: Successful mortgage forgiveness can raise credit scores, giving debtors access to more lucrative employment possibilities.

- Encouragement of Public Service: Plans for public servants’ forgiveness promote professions in fields like education, medicine, and government that advance society.

CONCLUSION:

For many Americans struggling with student debt, Biden loan forgiveness programs offer a ray of hope. By understanding the application process and the qualifying requirements, borrowers can pave the way to a more secure economic future. Public transport relief or speeding up your mortgage payment could lead to a better and more debt-free tomorrow. Remember that taking advantage of these opportunities and achieving your financial goals requires being proactive and remaining educated.

You can learn more about student loan forgiveness by clicking here: