Even though Apple constructs its iPhone with a delicate, yet sturdy design, their screens are still prone to damage. A cracked or shattered iPhone screen is a sight that no Apple user ever wants to see.

Even though Apple constructs its iPhone with a delicate, yet sturdy design, their screens are still prone to damage. A cracked or shattered iPhone screen is a sight that no Apple user ever wants to see.

If you are involved in a car accident in California and want to submit a claim, there are numerous procedures you can follow to protect your rights and seek compensation for your injuries. But how long does an accident settlement take?

The concept of copyright can sometimes seem complex and confusing, and understanding the duration of a copyright is crucial for both creators and users of copyrighted works. But how long is a copyright valid for?

Scooters have speedy end up a family name within the international of electrical Sukıtır, thanks to its innovative design and extraordinary build pleasant.

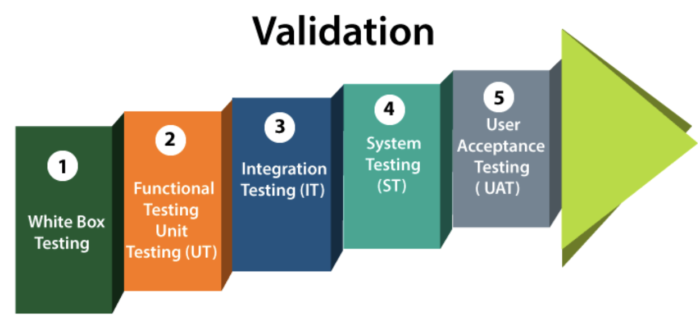

Comprehensive verification and testing strategies are required to catch faults early and confirm manufacturing quality.

Recently, you may have noticed a peculiar trend popping up at parties, events, or simply bouncing down the street in your neighbourhood – the ubiquitous inflatable animal.

In the ever-evolving landscape of medical science, CRISPR technology stands as a revolutionary force, reshaping the possibilities of genetic medicine..

In the dynamic world of accounting, the importance of legal protection cannot be overstated. Accounting businesses, big or small, are not immune to legal challenges.

Individuals who interact in freelance paintings have the possibility to pursue their tendencies even as working independently, which has contributed to its developing popularity in current years. Nevertheless, tax submission often offers problems for impartial contractors. In assessment to standard personnel, freelancers need to individually handle their tax coaching, an challenge that may be intricate and devour a full-size amount of time. In order to optimize their financial savings and reduce their tax obligations, it is essential for independent contractors to maximise deductions. By making use of a variety of gear and techniques, this guide will help independent contractors in filing their taxes strategically and maximizing self-employed deductions.

In terms of optimizing their 1099 tax Financial savings and completing their tax filings, freelancers come upon distinct boundaries. An inherent obstacle that individuals encounter is the limited availability of organisation-supplied benefits, consisting of retirement plans and health insurance. These costs can be substantial as they are the obligation of the freelancer. Freelancers may also, however, declare sure deductions that allows you to mitigate these costs and thereby decrease their taxable earnings.

The complexity of the tax regulation is an additional impediment for freelancers. Freelancers need to continue to be knowledgeable of the most current tax policies a good way to maximize the deductions which might be on hand to them, as tax laws are in a consistent country of flux. In addition, freelancers frequently have more than one income resources, which complicates the venture of accurately monitoring their expenses and earnings.

The flexibility and liability protection presented through Limited Liability Companies (LLCs) cause them to a famous enterprise structure among freelancers. The tax implications of an LLC, on the other hand, may be hard to check. Freelancers have the choice to complement the method by employing LLC tax calculators. Freelancers can estimate their IRS Tax legal responsibility the use of those on line equipment by means of coming into data regarding their profits, costs, and deductions. Freelancers can achieve a complete knowledge in their tax liabilities and pinpoint conditions in which they can optimize deductions via imparting unique information.

As a part of their self-employment responsibilities, freelancers are obligated to remit each the corporation and employee contributions to Medicare and Social Security taxes. The freelancer’s profits may be considerably impacted with the aid of those taxes. Freelancers may additionally make use of Medicare tax calculators to be able to ascertain the best quantum obligated. These calculators verify an appropriate self-employment tax legal responsibility with the aid of taking into account the freelancer’s earnings, deductions, and other pertinent factors. Freelancers can strategically manipulate their budget and reduce their tax legal responsibility via thinking of their tax obligations and optimizing their deductions.

In comparison to standard personnel who have taxes deducted from their paychecks, unbiased contractors (freelancers) are obligated to publish estimated tax payments on an ongoing basis. Quarterly payments to the IRS inside the form of envisioned tax bills cowl income and self-employment taxes. Penalties and hobby charges can be incurred for non-compliance with these payments.

In order to assure unique expected tax bills, it is imperative that freelancers assiduously screen their income and costs. Freelancers might also preserve facts in their earnings and deductions thru using accounting software or spreadsheets, which helps the estimation in their tax legal responsibility. Taking into attention any adjustments in income or deductions, freelancers can also are looking for the advice of tax experts that allows you to confirm the ideal quarterly payment amount.

There exist severa deductions that freelancers can utilize which will decrease their taxable earnings and optimize their tax financial savings. Examples of frequent deductions include:

Three. Health Insurance Premiums: As a commercial enterprise price, freelancers may deduct the fee of medical health insurance premiums, which encompass insurance for dental and imaginative and prescient.

Four. Retirement Contributions Freelancers may additionally deduct contributions to retirement plans from their taxable earnings, together with a Simplified Employee Pension (SEP) IRA or a solitary 401(ok).

In order to optimize their savings and reduce their tax duties, it is important for independent contractors to maximise deductions. Freelancers can strategically publish their taxes and maximize the advantages of to be had deductions by using resources together with LLC tax calculators, Medicare tax calculators, and information expected tax bills. It is imperative that unbiased contractors (freelancers) stay modern-day on the most current tax legislation and searching for steering from tax specialists with the intention to optimize their deductions at the same time as keeping compliance. Freelancers can optimize their tax savings through navigating the complexities of tax filing with meticulous attention to detail and strategic planning.

Working on a research paper can be a daunting task, but a well-crafted beginning sets the tone for a successful academic endeavor. The opening lines are your opportunity to captivate your audience and establish the groundwork for your research journey. In this comprehensive guide, we will explore the essential elements of starting a research paper, providing practical insights and strategies to help you navigate the crucial initial phase with confidence and precision. While the prospect of tackling a research paper independently is empowering, there are instances where seeking additional support, such as consulting with peers or discussing ideas with instructors, can enhance the quality of your work. Alternatively, considering professional assistance from reputable writing services and pay someone to do your research paper can be a viable option, allowing you to delegate specific tasks without compromising the integrity of your academic exploration.

Understanding Your Audience and Purpose: Before delving into the content, consider your audience and the purpose of your research paper. Whether you are writing for peers, academics, or a broader audience, understanding who will read your work and why helps tailor your introduction to meet their expectations. This foundational step ensures that your research aligns with the interests and knowledge level of your intended readership.

Crafting a Compelling Thesis Statement: The thesis statement is the heartbeat of your research paper, encapsulating the main idea and setting the trajectory for your argument. A compelling thesis should be clear, concise, and specific, providing a roadmap for your readers to navigate your research. Spend time refining this central element to ensure it accurately represents the core of your paper and entices readers to delve further.

Conducting a Thorough Literature Review: Start your research paper by conducting a thorough literature review. This step involves exploring existing research on your topic, identifying gaps, and understanding the current state of knowledge in the field. A well-informed literature review not only contextualizes your research but also helps you position your work within the broader academic conversation.

Establishing the Research Context: Provide your readers with a clear understanding of the context of your research. Set the stage by introducing the broader topic, its relevance, and any pertinent background information. This establishes a foundation for your specific research question or problem statement, allowing readers to grasp the significance of your work from the outset.

Choosing an Engaging Introduction Strategy: Consider various introduction strategies to capture your readers’ attention. This could involve starting with a thought-provoking quote, posing a rhetorical question, or presenting a surprising statistic. An engaging introduction creates an immediate connection with your audience, motivating them to invest their time in exploring the depths of your research paper.

Outlining the Scope of Your Research: Clearly outline the scope and limitations of your research in the introduction. Define the boundaries of your study, specifying what aspects you will cover and what falls outside its purview. This not only helps manage expectations but also demonstrates your awareness of the parameters within which your research operates.

Previewing the Paper Structure: Wrap up your introduction by providing a brief overview of the structure of your research paper. Preview the main sections and their respective purposes, guiding readers on the journey they are about to undertake. A well-structured preview enhances the clarity of your paper and prepares your audience for the logical progression of your argument. As you embark on this writing journey, it’s crucial to prioritize clarity and coherence. While seeking feedback from peers and instructors can be valuable, exploring UK Writings reviews can offer insights into the experiences of other students who have sought writing assistance. Understanding the perspectives of fellow learners can inform your decision-making process and provide a nuanced understanding of how external support can contribute to the success of your research paper.

In conclusion, initiating a research paper is a meticulous process that requires careful consideration of your audience, a well-crafted thesis statement, and a strategic approach to contextualizing your research. By implementing these key strategies, you can create a compelling start to your research paper, laying the groundwork for a coherent and impactful academic exploration.

Furthermore, the initiation of a research paper is not merely a technicality but an opportunity for intellectual engagement and scholarly contribution. As you embark on this academic journey, remember that your introduction serves as a gateway, inviting readers into the world of your research. Beyond the structural components, the initiation phase is a chance to infuse enthusiasm into your work, reflecting the passion and curiosity that led you to explore the chosen topic. A well-crafted beginning not only guides the reader logically through your research but also instills a sense of intrigue and anticipation, encouraging them to accompany you on a meaningful exploration of knowledge. Ultimately, the initiation of your research paper is your chance to make a lasting impression and establish the foundation for a robust and insightful academic endeavor.

For more information visit our homepage.