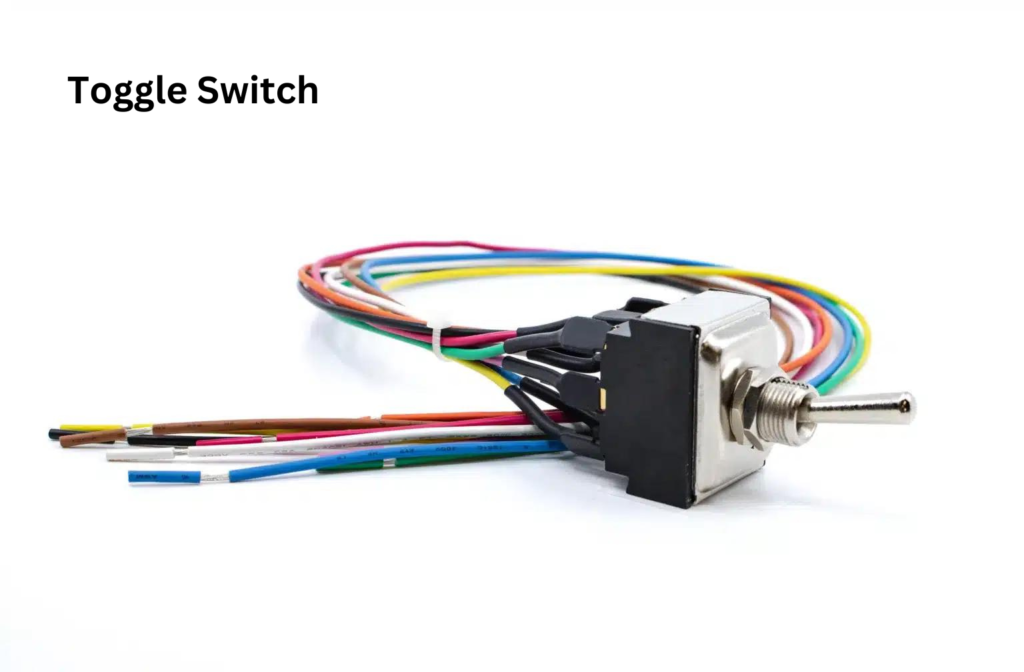

What Are Toggle switches?

Toggle switches are mechanical switches that are frequently used in electronic devices to regulate the flow of electricity. It is distinguished by having a manually operated handle or lever that regulates how much electrical current is transferred from the power source to a device (like a home appliance). The term “toggle” refers to the fact that it is made up of a lever or handle that can be moved between two positions. Lever, contacts, and housing are the three main parts of the switch.

Toggle Switch Definition:

An electrical switch known as a toggle switch is one that is manually operated by means of a mechanical lever, handle, or rocking mechanism. This switch, which has an easy-to-use on/off mechanism, is present in many machines and devices.

different kinds of toggle switches

- Single Pole Single Throw, or SPST: switches are the most basic kind of toggle switches. Two terminals on this that can be connected (on) or disconnected (off) are present. These are employed in devices like light bulbs that only need one control mechanism.

- SPDT (Single Pole Double Throw): type of switch. Two of them are outputs, and one is the input. The two output terminals can be used to switch the input. These are usually employed in systems where a user must choose between two possible states of operation.

- Double Pole Double Throw, or DPD: switches are capable of controlling two circuits at once and have six terminals. This switch allows for the same functionality as two SPDT switches in a single package.

Why Do We Use Toggle Switches?

When a straightforward on/off control is required, toggle switches are frequently used in a wide range of electronic circuits, appliances, lighting controls, and other applications. They can be used for a variety of purposes because they are dependable and strong.

Smaller toggles are frequently found in instrumentation, medical, networking, telecommunications, and instrument equipment. Industrial control panels, motor sports cars, commercial appliances, restaurant equipment, and recreational vehicles all use high power toggles.

Toggle switch applications:

Toggle switches are frequently used in commercial, industrial, and telecommunications equipment to enable and disable circuits. They are also frequently found in logic-level applications, control panels in airplanes, and automobiles.

There is a wide range of applications for toggle switches:

- found in electrical outlets for homes and businesses, car headlights, electronic toys, and exercise equipment (scale, treadmill).

- serve as the primary switch for air conditioning units or other industrial equipment, such as packaging machines and conveyors.

- used in a variety of digital devices, such as PDAs, cameras, phones, and mobile phones.

- a key component of medical devices like hospital call systems and blood pressure monitors.

Positive and Negative Aspects:

are some of the benefits of the toggle switch.

Using these switches with circuit boards is perfect.

- These switches are generally small in size, incredibly durable, and very easy to seal.

- These switches are excellent at controlling electricity.

- Both standard and small sizes are offered for these switches.

- A lever is used to extend and operate these.

- These switches are energy-efficient because they consume less electricity.

- These are powerful switches.

The following are some of the drawbacks of the toggle switch.

- When operating, these switches produce a clicking sound. They are larger and more substantial than rocker switches.

- A toggle lock washer is needed.

- Only low voltage circuits can use it.

Selecting the Appropriate Toggle Switch:

It can be difficult to choose the best toggle switch for a given application. The number of poles and throws (determined by the desired level of control), the mounting style, the type of terminal, and the current rating (measured in amperes) are all important factors to take into account. The choice may also be influenced by the environment in which the switch will be used; for example, outdoor or marine applications may call for a water-resistant switch.

Future Prospects for Toggle Switches:

Although the toggle switch’s basic design is still the same, technological advancements are producing switches with more features. These consist of programmable switches, switches with integrated LED indicators, and even wirelessly controllable switches that can be operated from a distance. In addition, the arrival of ‘smart’ switches that can be operated by voice commands or smartphone apps have been developed as a result of the rise of smart homes and IoT (Internet of Things) technologies.

Conclusion:

To sum up, toggle switches are an essential part of electrical systems and are used in a wide range of gadgets and applications. In spite of their simplicity, they have a big and lasting effect. Their dependability and functionality make them an essential component of contemporary electrical technology, from simple on/off light switches to intricate industrial controls. We can expect even more creative applications and modifications for these adaptable switches in the future, thanks to the continuous advancements in technology and the emergence of the Internet of Things.

for more Information visit our Homepage